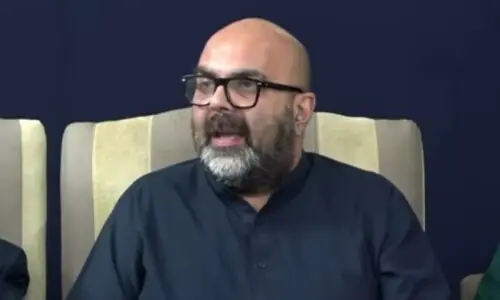

KARACHI: Emphasising building trust and cybersecurity in digital finance, Governor Jameel Ahmed said on Wednesday that the State Bank was in the advanced stages of establishing an innovation hub as it had launched the first cohort of its Regulatory Sandbox to test new ideas in areas such as inward remittances, open banking, and merchant onboarding.

Addressing the Future of Banking Summit 2025, Mr Jameel said the digital future is no longer a distant vision — it is our present reality. “To remain relevant, financial institutions must evolve rapidly, adopt global standards, and embrace innovation that enhances inclusion, efficiency, and customer trust,” he stressed.

He said that the global financial landscape is undergoing an extraordinary transformation, driven by advancements in artificial intelligence, big data analytics, 5G connectivity, and digital payments. These innovations are redefining how customers interact with financial institutions and how services are delivered across the economy.

He said that the SBP, along with other financial services regulators, must also evolve to meet the demands of a rapidly changing landscape.

The SBP has taken measures to safeguard the financial system from cyber threats and operational vulnerabilities, ensuring that innovation is matched with resilience and trust, he said.

He called upon banks and financial institutions to increase the pace of adoption of Raast and expand digital payment solutions for customers across the public and private sectors.

Mr Ahmad emphasised that ‘by working together — regulators, banks, fintechs, and policymakers — we can build a future where every Pakistani confidently participates in the digital economy’.

The SBP is also seeking cross-border payment integration using international standards like ISO 20022 for faster, safer remittances and trade-related transactions.

Published in Dawn, November 13th, 2025