China eyed for long-term investment

Martin Horne, co-head of global investments at Barings, said the Chinese market remains one of the most promising destinations for long-term investors. "China's asset management industry still has vast room for growth," he said, adding that Barings, which established its Shanghai office in 2018 after decades in Hong Kong, remains fully committed to deepening cooperation with the Chinese market.

His remarks came at a recent seminar hosted by Tsinghua University PBC School of Finance, where senior executives from the global asset manager voiced confidence in China's pursuit of high-quality development and long-term stability. They said the country's steady policy direction and expanding innovation capacity are opening new opportunities for global markets.

Li Weibo, Barings' economist and multi-asset strategist, said that since the start of the 14th Five-Year Plan (2021-25), China has made solid progress in pursuing "higher-quality, more structurally driven growth". He said that the forthcoming 15th Five-Year Plan (2026-30) is expected to reinforce this direction with greater focus on strategic self-reliance, innovation and sustainable development.

"China's long-term policy continuity provides clarity and confidence for global investors," he said. "We have a good understanding of China's policy cycles, which allows us to plan ahead."

He added that China's ongoing reforms, including the expansion of real estate investment trusts, the development of green finance and the introduction of new private-asset products, will open new channels for long-term capital.

In a broader market context, China took another step toward further opening its capital market to international investors as its first foreign-invested consumer real estate investment trust made a solid debut on the Shanghai Stock Exchange recently.

CapitaLand Investment Ltd, a Singapore-based property asset manager, listed CapitaLand Commercial C-REIT on the Shanghai bourse in early October. Analysts said the listing marks a key milestone in the internationalization and diversification of China's REIT market and offers a model for deeper foreign participation under the country's ongoing capital market reforms.

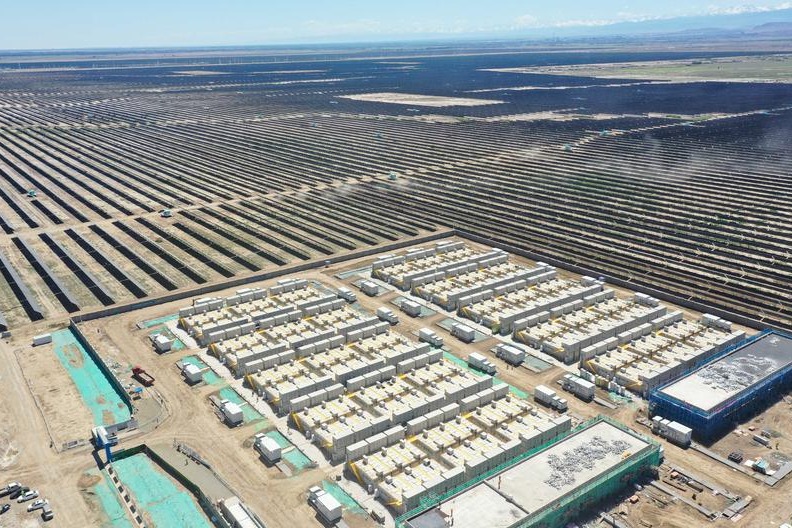

When discussing key industrial priorities in the forthcoming Five-Year Plan blueprint, both executives highlighted the transformative potential of emerging industries such as artificial intelligence, robotics and renewable energy.

Horne said China's openness to technological change gives it a unique advantage. "Look at how rapidly e-commerce became part of daily life," he said. "That same spirit of innovation means China can realize the benefits of digital transformation faster than many other economies."

He added that Barings is currently testing about 15 AI-related systems globally. "These technologies are reshaping every aspect of our business," he said.

Li said that while China's policy direction is clear, identifying long-term industrial winners will take time. He said the firm maintains diversified exposure across key sectors of the new industrial revolution — from AI and robotics to renewables — to capture potential growth as the market matures.

On the global market, Horne said that 2025 has been a broadly positive year for investors, though market signals remain mixed. "Gold has led returns — which often reflects caution — while Chinese technology stocks and Bitcoin have also posted strong gains, suggesting renewed risk appetite," he said.

He added that global investors are seeking diversification amid concerns over sovereign debt and persistent inflation pressures in developed economies. In this context, China's steady monetary policy and expanding green and REIT markets offer both stability and growth potential for international capital.

Horne said that as the world economy becomes more interconnected, flexibility and long-term vision are increasingly vital. "What looks attractive this year may change quickly. For investors, patience and adaptability will be key to success in the next five years."

Today's Top News

- Xi meets Spanish king in Beijing

- Xi holds welcome ceremony for Spanish king

- Astronauts' return mission proceeds smoothly

- Vocational education helps youth break the cycle of poverty

- GBA goes from bold blueprint to living reality

- Giving a human touch to tech innovation